Vậy nên F0 như em vẫn bị vặt như thường bác ạ

Nghe nói Fn cũng có thể bị lỗ. Sau khi tính toán, nhận tin thị trường tin nội gián … thì vẫn còn yếu tố hên xui.

Nhân tiện nhớ ông hàng xóm qua campuchia đánh bài thắng lần 1 hứa không quay lại, nhưng được vài bữa là lại mò sang nộp. VN nhiều người thắng chứng được 1 cục, nghỉ lấy tiền đi làm việc khác và chưa quay lại

Ở những nơi chứng có từ nhiều năm trước, cũng có người mua cp xong bỏ quên vài chục năm sau được cả mớ. Kiểu như trong phim gì mà Tom Hanks vai chính, mua cổ phiếu Apple nhưng chỉ mang máng là cổ phiếu của công ty gì đó về thực phẩm, vậy mà cả đoạn đời sau dư tiền

Ý tôi muốn nói là cái gì cũng có chút … hên xui ![]()

Nhưng nếu bỏ tiền mua chứng, theo tôi nghĩ nên tìm hiểu mấy hình đồ thị gì đó. Khổ ở chỗ tìm hiểu 1 loại/kiểu đồ thì đã vỡ đầu rồi, mà bây giờ hình như có nhiều tài liệu về nhiều loại, nghĩ tới đó đã thấy ngại

Đúng như tỷ phú Trần Đình Long dự báo, lợi nhuận quý 2 của Hoà Phát còn hơn 4.000 tỷ, sụt giảm sâu so với các quý trước

Triệu chứng của sự chuyển giai đoạn ạ. Bắt đầu sang giai đoạn các hàng hoá giảm dần về cân bằng, thừa cung, tồn kho nhiều,…các nhà đầu cơ hoạt động. Cuối giai đoạn này sẽ là khu đáy thị trường bởi chính sách tiền tệ được nới lỏng dần, GDP bắt đầu tăng trưởng chậm, đi ngang.

Toàn tiếng anh, lại là hình nên không copy nhờ google translate được, nên khó quá ![]()

Giờ này hơi mơ màng, nên nhìn cái đồ thị Real GDP, chỉ ấn tượng 2 điểm Peak và liên tưởng đến thứ khác … . ![]()

à, ở VN, tại thời điểm nào đó, nghe nói các con số thống kê về GDP, lạm phát… có thể không sát thực tế

Updated January 13, 2022

Introduction to U.S. Economy: The Business Cycle and Growth

On July 19, 2021, the National Bureau of Economic Research (NBER), an independent, nonprofit research group, announced that economic activity in the United States reached a post-COVID-19 pandemic onset low in April 2020 and subsequently exited a two-month recession. Economic activity did not recover to its pre-pandemic level until mid-2021. This In Focus discusses the business cycle, how recessions are determined, and potential causes and effects of these fluctuations in the economy.

What Is the Business Cycle?

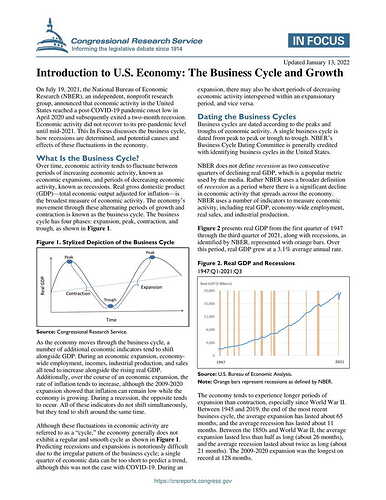

Over time, economic activity tends to fluctuate between periods of increasing economic activity, known as economic expansions, and periods of decreasing economic activity, known as recessions. Real gross domestic product (GDP)—total economic output adjusted for inflation—is the broadest measure of economic activity. The economy’s movement through these alternating periods of growth and contraction is known as the business cycle. The business cycle has four phases: expansion, peak, contraction, and trough, as shown in Figure 1.

Figure 1. Stylized Depiction of the Business Cycle

expansion, there may also be short periods of decreasing economic activity interspersed within an expansionary period, and vice versa.

Dating the Business Cycles

Business cycles are dated according to the peaks and troughs of economic activity. A single business cycle is dated from peak to peak or trough to trough. NBER’s Business Cycle Dating Committee is generally credited with identifying business cycles in the United States.

NBER does not define recession as two consecutive quarters of declining real GDP, which is a popular metric used by the media. Rather NBER uses a broader definition of recession as a period where there is a significant decline in economic activity that spreads across the economy. NBER uses a number of indicators to measure economic activity, including real GDP, economy-wide employment, real sales, and industrial production.

Figure 2 presents real GDP from the first quarter of 1947 through the third quarter of 2021, along with recessions, as identified by NBER, represented with orange bars. Over this period, real GDP grew at a 3.1% average annual rate.

Figure 2. Real GDP and Recessions 1947:Q1-2021:Q3

Source: Congressional Research Service.

As the economy moves through the business cycle, a number of additional economic indicators tend to shift alongside GDP. During an economic expansion, economy-wide employment, incomes, industrial production, and sales all tend to increase alongside the rising real GDP. Additionally, over the course of an economic expansion, the rate of inflation tends to increase, although the 2009-2020 expansion showed that inflation can remain low while the economy is growing. During a recession, the opposite tends to occur. All of these indicators do not shift simultaneously, but they tend to shift around the same time.

Although these fluctuations in economic activity are referred to as a “cycle,” the economy generally does not exhibit a regular and smooth cycle as shown in Figure 1. Predicting recessions and expansions is notoriously difficult due to the irregular pattern of the business cycle; a single quarter of economic data can be too short to predict a trend, although this was not the case with COVID-19. During an

Source: U.S. Bureau of Economic Analysis.

Note: Orange bars represent recessions as defined by NBER.

The economy tends to experience longer periods of expansion than contraction, especially since World War II. Between 1945 and 2019, the end of the most recent business cycle, the average expansion has lasted about 65 months, and the average recession has lasted about 11 months. Between the 1850s and World War II, the average expansion lasted less than half as long (about 26 months), and the average recession lasted about twice as long (about 21 months). The 2009-2020 expansion was the longest on record at 128 months.

Introduction to U.S. Economy: The Business Cycle and Growth

The most recently completed recession in the United States prior to the COVID-19 pandemic, the so-called Great Recession, began in December 2007 and ended in June 2009, a total of 18 months. Since the 1850s, in the United States, 12 other recessions have lasted as long as or longer than the Great Recession; however, all these recessions occurred before the Great Depression of the 1930s. The COVID-19 recession technically lasted just two months. However, marking the end of a recession does not mean that the economy has returned to its pre-recession level of economic activity; it takes time for the economy to recover from its low point.

In addition, other economic conditions can remain distressed. For example, following the Great Recession, the economy did not return to what is considered “full employment” until summer 2015, six years after the end of the technical recession. Because the COVID-19 recession had an unusual cause and was large and sudden, the economy is still experiencing disruptions.

Short-Term Economic Growth

In the short term, the business cycle is primarily driven by fluctuations in consumer spending and business investment. Over the business cycle, the rate at which the economy is expanding or contracting can be significantly different. For example, during the 2009-2020 expansion, real GDP grew at an average pace of about 2.3% per year, whereas real GDP shrank at an annual rate 31.4% in the second quarter of 2020 before growing at an annual rate of 33.1% in the third quarter. Over longer periods of time, the volatility of the business cycle fades to reveal a pattern of growth in the economy.

Potential Causes of the Business Cycle

In general, the business cycle is governed by aggregate demand (total spending) within the economy, but recessions can also be caused by sudden shocks to supply, which will impact both aggregate supply and aggregate demand. The current recession is unusual in that it displays elements of both demand and supply shocks. This section discusses these types of shocks in more detail.

Demand Shocks

Changes in consumer or business confidence can impact aggregate demand. If individuals believe the economy will perform poorly in the future, they are likely to increase how much they save to prepare for lean times ahead. The associated decrease in spending would lower aggregate demand. Similarly, if businesses perceive that the economy is about to enter a recession, they are less likely to make investments in new machinery or factories because consumers would not be able to afford their new products during the recession.

The COVID-19 public health crisis contributed to the March-April 2020 recession in this manner. Uncertainty surrounding the virus and the state of the economy combined with high unemployment levels resulted in decreased consumption and increased saving (as a percentage of income) on the part of consumers and decreased desire to increase capital investment on the part of firms.

Supply Shocks

Events outside of the United States can often impact aggregate demand inside the United States, such as the 1979 oil shock that led to increased prices across the U.S. economy, resulting in a recession. In some ways, the current recession is also an example of a supply shock: The need for social distancing has halted commerce significantly and created challenges in supply chains. Whereas demand for certain products has been high and led to corrections in some supply chains (e.g., toilet paper, cleaning products), demand for many products has been low. Should aggregate demand increase, the economy may experience more unforeseen supply issues.

Policy Options

Government policy, specifically monetary and fiscal policy, can impact aggregate demand either directly or indirectly. Congress, together with the President, is responsible for fiscal policy in the United States through changes in the level of government spending and tax revenue. Fiscal policy can directly increase aggregate demand by increasing government spending, reducing taxes, increasing government transfers to individuals, or a combination of the three. During a recession, the government typically finances these policies by borrowing money, referred to as deficit financing. The government has used fiscal stimulus tools during the current crisis when, for example, it sent out stimulus checks directly to consumers or when it temporarily increased unemployment benefits.

Monetary policy can also be used to impact aggregate demand. The Federal Reserve implements monetary policy by changing short-term interest rates and the availability of credit in the economy. For example, lowering interest rates, which the Federal Reserve did in response to COVID-19, can encourage businesses to make new investments and individuals to buy new goods, as lower interest rates make it less expensive to borrow money.

Fiscal and monetary policy, when implemented successfully, can help reduce economic volatility. When unsuccessful, these policies may exacerbate the fluctuations of the business cycle. The fiscal and monetary policy options discussed in this section are countercyclical policies, meaning they work to counter the business cycle. For example, countercyclical fiscal policy might include increasing government spending during a recession and decreasing government spending during an expansion. However, growth-oriented policies, when timed improperly, can cause the economy to overheat (growing at an unsustainable rate) and subsequently cause a downturn.

CRS Resources

CRS In Focus IF10408, Introduction to U.S. Economy: GDP and Economic Growth, by Mark P. Keightley and Lida R. Weinstock

(Note: This In Focus was originally authored by Jeffrey Stupak, former CRS Analyst in Macroeconomic Policy.)

Lida R. Weinstock , Analyst in Macroeconomic Policy

IF10411

Introduction to U.S. Economy: The Business Cycle and Growth

Disclaimer

This document was prepared by the Congressional Research Service (CRS). CRS serves as nonpartisan shared staff to congressional committees and Members of Congress. It operates solely at the behest of and under the direction of Congress. Information in a CRS Report should not be relied upon for purposes other than public understanding of information that has been provided by CRS to Members of Congress in connection with CRS’s institutional role. CRS Reports, as a work of the United States Government, are not subject to copyright protection in the United States. Any CRS Report may be reproduced and distributed in its entirety without permission from CRS. However, as a CRS Report may include copyrighted images or material from a third party, you may need to obtain the permission of the copyright holder if you wish to copy or otherwise use copyrighted material.

https://crsreports.congress.gov | IF10411 · VERSION 11 · UPDATED

Đang muốn mua HPG hoặc NKG, mặc dù năm nay ngành thép giảm lãi

Nhưng tin này ra, không biết có phải lái chuẩn bị gom hàng diện rộng ?

Hên xui quá

Thôi thì… đợi

Dung hoi vi sao ca map ko them choi. Chi co nho le choi voi nhau thoi.

Nếu chỉ có những người bỏ tiền ra mua cổ phiếu chờ cổ tức hoặc chờ doanh nghiệp làm ăn phát đạt, thì giá cổ phiếu tăng giảm theo doanh nghiệp

Thì chắc cũng vẫn tốt

Nhưng t thấy, sau vài tuần nhìn ngắm, có cổ phiếu tăng giá không phải vì giá trị của nó, mà do ảo ảnh từ những người liên tục mua bán cổ phiếu đem lại

Nhóm đó có thể là: Tự doanh của các công ty chứng khoán, nhà đầu tư nước ngoài, những người mua bán cp với mục đích lấy lời nhanh,…

T không quen biết mấy người nhiều tiền, không được tham gia đội nhóm nào… nên thấy hên xui quá

Nếu có đội lái nào cho t một slot thì t cũng theo

Chơi solo 1 mình, nhảy theo họ không đúng nhịp là tèo, nhảy sớm thì có khi chỉ đủ trả tiền thuế phí

Thấy tin đồn: Ngày mai xanh

Bác nhầm nhóm rồi bác ơi. Không biết bác có phải bác Thanh11 ngày xưa không. Còn nếu là bác ấy t vẫn khuyên là dừng vào thị trường 1 thời gian cho tâm ổn lại . Chứ cứ vào nhiều nó tảu hỏa nhập ma ấy.

T không phải Thanh11, mới chơi chứng vài tuần thôi

Mặc dù đang bị tẩu hỏa nhập ma, nhưng vẫn sẽ vào f247 để tìm thông tin ra tiền,

Làm phiền các bạn ở topic này thì sẽ không vào đây nữa thôi ![]()

Bác Nam cho E hỏi vụ lãi suất trái phiếu tăng mà mọi người đang nói tới có ảnh hưởng mạnh lên ck ko ah và nên làm gì bây jo A

Đầu tư bao gồm cổ phiếu và trái phiếu. Do nhà đầu tư lựa chọn. Trái phiếu tùy loại mà có độ an toàn khác nhau. Tùy nav nhà đầu tư mà phân chia tỉ lệ cổ phiếu/ trái phiếu. Trái phiếu ngắn hạn tăng sẽ thu hút nhà đầu tư nhiều hơn. Đánh giá thì phải có dữ liệu. Nam nói định tính sơ qua như thế.

Chưa qua con bão này lại cơn bão khác kéo tới,nản vì tập bơi đường trường Bác ah.

Không sao, nhìn xa một chút, mệt mỏi thì nghỉ ngơi đi, thời gian sau quay lại gom sau. Không cần phải vật lộn với gấu làm gì, đợi cưỡi bò có phải thích hơn không?

anh Nam cho em hỏi 1 câu nhé, theo anh view thì timing nào thị trường mới thật sự tới đáy trung hạn của chu kỳ này hả anh? tầm giữa năm sau ko anh nhỉ?